November 16, 2006

I highly recommend his excellent work, "Free To Choose".

He was 94. And he will be missed. R.I.P., Uncle Milton.

Posted by: Gary at

02:05 PM

| No Comments

| Add Comment

Post contains 97 words, total size 1 kb.

September 14, 2006

Oil is traded in contracts for future delivery, and companies that take physical delivery of oil are just a small part of total trading. Large pension and commodities funds are the big traders and they're seeking profits. They've sunk $105 billion or more into oil futures in recent years, according to Verleger. Their bets that oil prices would rise in the future bid up the price of oil.$1.15? Holy crap!That, in turn, led users of oil to create stockpiles as cushions against supply disruptions and even higher future prices. Now inventories of oil are approaching 1990 levels...

...As it stands now, the recent oil-price slump has brought the national average for a gallon of unleaded gasoline down to $2.59, according to the AAA motor club. In the Seattle area, prices per gallon have fallen to $2.856 currently from $3.071 a month ago, a decline of 7 percent, according to AAA.

Should oil traders fear that this downward price spiral will get worse and run for the exits by selling off their futures contracts, Verleger said, it's not unthinkable that oil prices could return to $15 or less a barrel, at least temporarily. That could mean gasoline prices as low as $1.15 per gallon.

Other experts won't guess at a floor price, but they agree that a race to the bottom could break out.

I'm starting to regret pre-paying my home heating oil for the winter. Sigh.

But if gas prices were to fall even as far as $1.50 per gallon, the resulting savings would act like a tax cut and increase discretionary income. On an individual basis, this isn't all that much but multiply the savings by about 150 million drivers across the U.S.

That's a lot of beer money.

Bet yer lookin' at the poll in the sidebar a little differently right now, huh?

Posted by: Gary at

03:10 PM

| Comments (1)

| Add Comment

Post contains 333 words, total size 2 kb.

September 12, 2006

No, it's not a Bush-Rove election surprise. The President doesn't deserve credit anymore than he deserves the blame for rising prices.

Too many people who are ignorant of economics fail to grasp this concept. Fortunately, however, the Democrats plan of using this as a club to beat the GOP over the head with is evaporating before their eyes.

Now there is plenty of blame to go around for the long-term situation, like squishy Liberals (in both parties) who manage to torpedo ANWR drilling bills every year. Imagine what prices would be today if we went in that direction ten years ago.

Posted by: Gary at

11:00 AM

| Comments (1)

| Add Comment

Post contains 127 words, total size 1 kb.

July 12, 2006

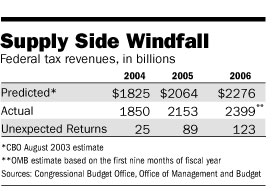

The real news, and where the policy credit belongs, is with the 2003 tax cuts. They've succeeded even beyond Art Laffer's dreams, if that's possible. In the nine quarters preceding that cut on dividend and capital gains rates and in marginal income-tax rates, economic growth averaged an annual 1.1%. In the 12 quarters--three full years--since the tax cut passed, growth has averaged a remarkable 4%. Monetary policy has also fueled this expansion, but the tax cuts were perfectly targeted to improve the incentives to take risks among businesses shell-shocked by the dot-com collapse, 9/11 and Sarbanes-Oxley.A picture (or graph) is worth a thousand words:This growth in turn has produced a record flood of tax revenues, just as the most ebullient supply-siders predicted. In the first nine months of fiscal 2006, tax revenues have climbed by $206 billion, or nearly 13%. As the Congressional Budget Office recently noted, "That increase represents the second-highest rate of growth for that nine-month period in the past 25 years"--exceeded only by the year before. For all of fiscal 2005, revenues rose by $274 billion, or 15%. We should add that CBO itself failed to anticipate this revenue boom, as the nearby table shows. [see below] Maybe its economists should rethink their models.

Remember the folks who said the tax cuts would "blow a hole in the deficit?" Well, revenues as a share of the economy are now expected to rise this year to 18.3%, slightly above the modern historical average of 18.2%. The remaining budget deficit of a little under $300 billion will be about 2.3% of GDP, which is smaller than in 17 of the previous 25 years. Throw in the surpluses rolling into the states, and the overall U.S. "fiscal deficit" is now economically trivial.

Sorry, Mr. Krugman, but your economic models are based on variables that exist only in the land of Liberal "make-believe". Tax cuts worked in the 1960's under Kennedy, in the 1980's under Reagan and now - third times the charm - they're paying dividends in the dawn of the 21st century under Dubya. I know Liberals love to "soak the rich". It's their chief economic mantra. I used to harbor that myopic mentality back when I was young and stupid. It made sense on an emotional level. Well, guess what? When you collect more tax revenue from the rich, you're soaking them more than you can imagine.

The same crowd that said the tax cuts wouldn't work, and predicted fiscal doom, are now harrumphing that the revenues reflect a windfall for "the rich." We suppose that's right if by rich they mean the millions of Americans moving into higher tax brackets because their paychecks are increasing.If Democrats are so convinced that the current tax code is still so unfair and that it will spell disaster in the future, why not call the GOP's bluff? Why not make the cuts that are due to expire in 2010 permanent? If the Republicans are wrong and the economy tanks because of the "crippling" deficit, it would be the perfect opportunity to win back BOTH houses of Congress and hike them back up. They won't do that because deep down they know that their class-warfare rhetoric is bullshit. If you make the cuts permanent, no one is going to elect someone who campaigns on raising them again.Individual income tax payments are up 14.1% this year, and "nonwithheld" individual tax payments (reflecting capital gains, among other things) are up 20%. Because of the tax cuts, the still highly progressive U.S. tax code is soaking the rich. Since when do liberals object to a windfall for the government?

But the Democrats wouldn't knowingly tank the economy for political gain, you say? Wrong. They would in a hearbeat. Just like they hope and pray for American failure in Iraq. What's bad for the country is good for them, politically. Or at least they'll do their damndest to try and make it that way.

Posted by: Gary at

09:10 AM

| Comments (1)

| Add Comment

Post contains 715 words, total size 4 kb.

March 29, 2006

Laws and theories of Economics are not that difficult to understand if you can move beyond the abstract to the concrete. So when I stumble upon something that even I can fathom, I like to share.

Tom at Libertarian Leanings has a great post about microeconomics and human behavior that explains "why price supports and price ceilings don't work and why the Kennedy, Reagan, and Bush tax cuts do work". People often see Free Market Capitalism as a "system" when in fact it really is nothing more than the natural state of an economy when market forces are allowed to play themselves out. It's with the systems of Socialism and Communism that you deal with controls that fly in the face of human behavior, the one variable that cannot be "controlled".

The laws of Economics are no less real than, say, the laws of Physics. You can try to influence them or change them or manipulate them. But when you do, you end up with so many unintended consequences. The laws of Economics and Physics are both constants in their particular equations. You can no more control economic forces than you can control the weather.

Anyway, go read Tom's post. He's the Economics guy and he at least knows what he's talking about.

Posted by: Gary at

07:15 AM

| No Comments

| Add Comment

Post contains 298 words, total size 2 kb.

December 17, 2005

Hat Tip: Amy Ridenour

Posted by: Gary at

09:20 PM

| No Comments

| Add Comment

Post contains 34 words, total size 1 kb.

December 07, 2005

Economic ignorance, misconceptions and superstition drive us toward totalitarianism because they make us more willing to hand over greater control of our lives to politicians. That diminishes our liberties. Remember the gasoline price controls of the 1970s? The price controls caused shortages. To deal with the shortages, purchases were restricted. Then national highway speed limits were enacted. Then there were more calls for smaller and less-crashworthy cars.Now go read the whole thing. And pay attention, one day you'll be tested on this material when you encounter a Liberal.In the recent gasoline supply shocks, we didn't see the shortages, long lines and closed gas stations of the 1970s. Why? Prices were allowed to perform their allocative function -- get people to use less gas and suppliers to provide more.

Economic ignorance is to politicians what idle hands are to the devil. Both provide the workshop for the creation of evil.

Posted by: Gary at

04:02 PM

| No Comments

| Add Comment

Post contains 174 words, total size 1 kb.

October 24, 2005

Larry Kudlow's reaction is "good choice" though I get the impression that he's not doing cartwheels. Check his site for updates.

For what it's worth, the market shot up as soon as this information came out.

UPDATE: 2:30pm

Kudlow's "bullet points" and Greenspan gives a "thumbs up".

Posted by: Gary at

12:54 PM

| Comments (1)

| Add Comment

Post contains 80 words, total size 1 kb.

October 20, 2005

Here our earnest tour guide raises his chin a bit and proudly declares that the first ads are dedicated to saving the family farm. When I burst out laughing, 22 sets of angry eyes glared at me. For the past 100 years, as the productivity of the American farmer has surged to unprecedented heights, the number of Americans working in agriculture to feed the world has fallen from 35 workers per 100 to two.Now let's remember that Ben Cohen and Jerry Greenfield make a tidy fortune when they sold out to Unilever about five years ago. Hey, good for them. It was their idea, their product and their marketing strategy. They deserve the spoils. But it's kind of hypocritical for Liberals to attack free-market economics and give these particular "capitalist pigs" a pass simply because "they care, man".This is called progress. What is Ben & Jerry's proposed solution, anyway? To turn back the clock and abolish the tractor? Many Americans seem to be under the illusion that the small family farmer has lived a carefree idyllic lifestyle. In truth, this livelihood has traditionally involved backbreaking toil, work-days that last from sun-up to sundown, and monotony--which is why sons and daughters have been fleeing the farm for five generations. The only people who actually want to save small farms are people who've never worked on a farm.

The Ben & Jerry's ads moan that the corporatization of farming is a horrid trend. I couldn't help asking our tour guide during the Q-&-A why, if corporatization of farming is such a bad thing, that isn't also true of the corporatization of ice cream. Those same 22 pairs of eyes glare back at me.

It's hard to feel sorry for the allegedly aggrieved farmers who have "lost their land" to corporate greed. In Northern Virginia, where I live (and in many other areas), the farmers have sold their acreage for about 20 times what they paid and now they own million-dollar bungalows in Palm Beach, while the rest of us get to shop at glorious-though-crowded strip malls. It's a win-win.

At the end of the tour--which I highly recommend for the free scoops along the way--it's a relief to know that of all the dimwitted, touchy-feely, left-wing social causes Ben & Jerry's could waste $5 million on, this one will probably do society and our beloved capitalistic system the least damage. So as a lover of freedom, I can, in good conscience, shell out $4 a pint for Coffee Heath Bar Crunch, eat it out of the carton in one sitting--my arteries be damned--and still feel good about myself in the morning.

Posted by: Gary at

08:57 AM

| No Comments

| Add Comment

Post contains 519 words, total size 3 kb.

115 queries taking 0.053 seconds, 230 records returned.

Powered by Minx 1.1.6c-pink.